1065 Partnership Tax Filing

March 30, 2025 2025-03-30 2:441065 Partnership Tax Filing

1065 Partnership Tax Filing

1065 Partnership Filing

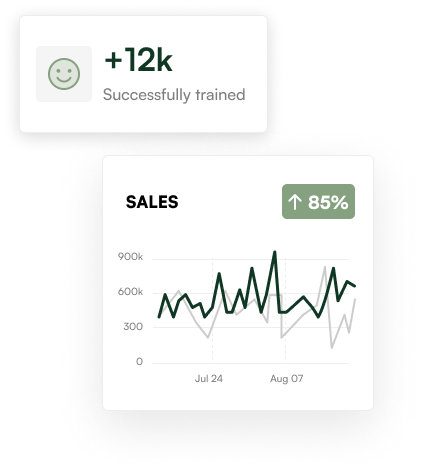

Filing taxes for your partnership? We make the process smooth, accurate, and stress-free. Our team ensures your IRS Form 1065 is completed properly—and that each partner receives their correct Schedule K-1.

Partnership Tax Filing Services

Done Right. On Time. Hassle-Free.

At SimpleBooksNow, we specialize in helping partnerships file IRS Form 1065 and distribute accurate K-1s to each partner. Whether you’re filing for the first time or catching up on previous years, we ensure accuracy, compliance, and peace of mind.

What’s Included:

Preparation and filing of IRS Form 1065

Generation and distribution of Schedule K-1s

Income and expense reconciliation

Compliance with IRS deadlines

Review of partnership agreements for tax alignment

State partnership tax filings (if applicable)

Step 01

Review Your Partnership’s Financials

We begin with a detailed look at your books, partner agreements, and financial activity to ensure accuracy and alignment.

Step 02

Prepare & File Your Return

We prepare and electronically file Form 1065 and generate accurate K-1s for each partner—ensuring timely and correct delivery.

Step 03

Support Your Partners Too

We make sure each partner understands their K-1 and answer any follow-up questions they might have, so everyone’s on the same page.

Simple Steps to Success

Speak With A Partnership Filing Specialist

Let us handle the complexities of partnership tax filings while you focus on running the business.

Ready to start?

Whether you’re new to partnerships or managing multiple partners, we’ll make sure your filings are done right the first time.