1120-S Corporate Tax Filing

March 30, 2025 2025-03-30 0:521120-S Corporate Tax Filing

1120-S Corporate Tax Filing

1120-S Filing Services

S-Corp taxes don’t have to be complicated. At SimpleBooksNow, we make sure your 1120-S return is filed accurately and on time—so you can focus on running your business while we handle the numbers.

S-Corp Tax Filing Services

Expert Filing. Maximum Compliance.

From preparing Form 1120-S to issuing Schedule K-1s to shareholders, we cover everything your S-Corporation needs to file correctly and avoid penalties. Our bilingual team ensures your return is accurate, optimized, and fully compliant with IRS rules.

What’s Included:

Preparation and filing of IRS Form 1120-S

Shareholder Schedule K-1 creation and delivery

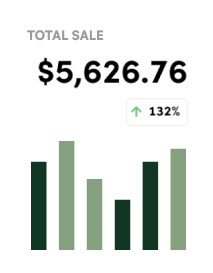

Business income and expense reconciliation

Tax-saving deduction analysis

Year-end financial summary reports

State S-Corp filing support (if applicable)

Step 01

Review Your Financials & Structure

We evaluate your financial records, shareholder information, and entity setup to ensure everything is aligned with IRS requirements.

Step 02

Prepare and File Your Return

We complete and file your Form 1120-S and generate K-1s for each shareholder—keeping you compliant and on schedule.

Step 03

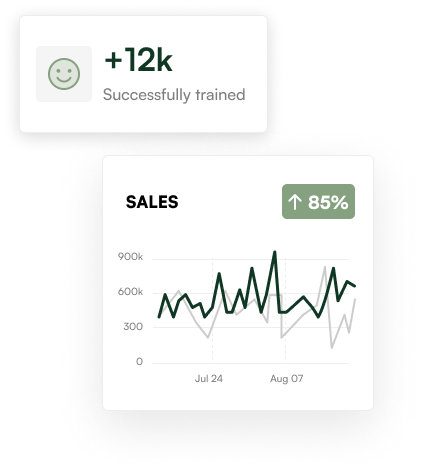

Strategize for Next Year

After filing, we help identify ways to optimize deductions, increase savings, and plan smarter for the year ahead.

Simple Steps to Success

Speak With A Corporate Filing Expert

Filing your S-Corp taxes doesn’t have to be stressful. Let our experienced team handle the details while you stay focused on running and growing your business.

Ready to start?

We’ve filed hundreds of 1120-S returns and know how to get it done right—the first time.