Corporate Tax Audits

October 3, 2022 2025-03-29 19:58Corporate Tax Audits

Corporate Business Services

Corporate Tax Audits

Don’t panic—we’ve helped countless businesses navigate audits with confidence. We’ll review your financials, communicate with the IRS, and protect your business every step of the way.

Corporate Tax Audits

Navigate Your Tax Audit with Confidence

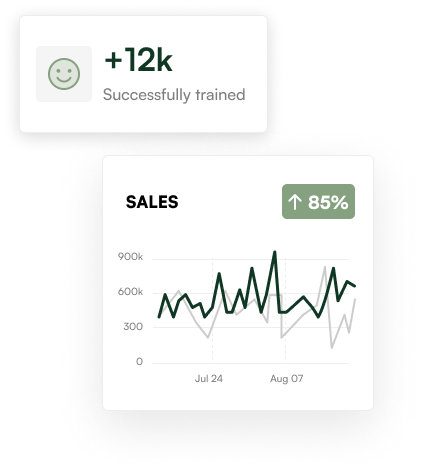

Running a corporation means more than just offering a great product or service. It means staying compliant, financially organized, and always ready for what’s next.

At SimpleBooksNow, we provide end-to-end corporate services that ensure your business is running smoothly behind the scenes.

Whether you're a new S-Corp or a seasoned corporation, we help you stay audit-ready, tax-optimized, and confidently in control of your financial future.

We Start With the Facts

We Speak on Your Behalf

We Help You Move Forward

Simple Steps to Success

Speak With A Tax Audit Professional

Take control of your audit process and get the clarity you need to move forward with confidence. Whether you're facing an IRS inquiry or preparing your records in advance, we’ll help you stay protected and informed.

Ready to start?

The best-run companies aren’t immune to audits—but they’re prepared for them. And with the right guidance, you can be too. Let's simplify the process, reduce the stress, and get you back to business.