Corporate Deductions

March 30, 2025 2025-03-30 2:36Corporate Deductions

Business Tax Deductions & Optimization

Corporate Deductions

If you're a business owner, chances are you're leaving money on the table. At SimpleBooksNow, we help you uncover every deduction your business qualifies for—safely and legally.

Corporate Deduction Services

Maximize Your Deductions

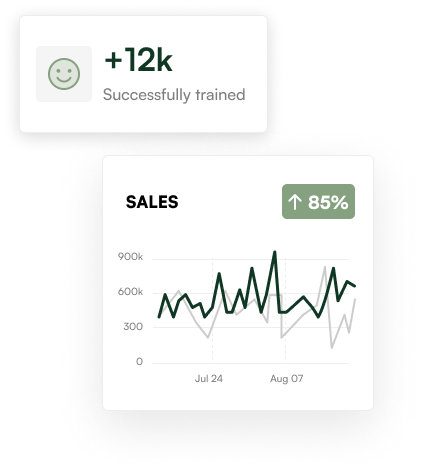

At SimpleBooksNow, we help you legally reduce your business tax liability by identifying missed deductions, correcting common filing errors, and implementing smarter deduction strategies.

Whether you’ve been in business for years or just getting started, we’ll ensure you’re not overpaying and that your records are always audit-ready.

What's Included:

Full review of business expense categories

Identification of missed or underutilized deductions

IRS-compliant recordkeeping practices

Business classification review

Year-round deduction planning & optimization

Step 01

We Review What You’re Spending

We start by examining your business expenses and comparing them to industry benchmarks to uncover overlooked deductions and common areas of overspending.

Step 02

We Maximize Your Savings

We identify deductions you may not have claimed, show you how to properly document them, and help you implement better expense tracking habits.

Step 03

We Help You Plan Ahead

Once we’ve optimized your deductions, we build a strategy for year-round tax savings—so you’re never scrambling at tax time again.

Simple Steps to Success

Speak With A Corporate Deduction Expert

Stop overpaying and start maximizing what your business keeps. Our deduction review process ensures you’re taking advantage of every opportunity available to you.

Ready to start?

Most businesses miss thousands in deductions simply because no one has taken the time to look. We will.