Business Payroll Services

March 30, 2025 2025-03-30 2:39Business Payroll Services

Payroll Services

Small Business Payroll Services

Paying your team shouldn't be stressful. Our Payroll Services make sure your employees are paid accurately and on time—while keeping you fully compliant with all state and federal regulations.

Payroll Services

Stress-Free Payroll for Your Business.

At SimpleBooksNow, we handle the complexities of payroll so you don’t have to. From paycheck processing to payroll tax filings, we’ve got every detail covered. Our bilingual team supports small and medium-sized businesses with fast, accurate, and fully compliant payroll management.

What’s Included:

Employee payroll processing (W-2 and 1099)

Direct deposit setup

Payroll tax withholding and filings

Quarterly and annual payroll reports

State and federal compliance

Year-end W-2 and 1099 preparation

Step 01

We Set Up Your Payroll System

We start by setting up a reliable payroll system that fits your business size, employee type, and preferred pay schedule.

Step 02

We Handle Every Pay Cycle

You provide the hours—we handle the rest. We process payments, deduct taxes, and ensure your team is paid on time, every time.

Step 03

We Keep You Compliant

From payroll tax filings to year-end reports, we take care of the paperwork and deadlines—so you stay compliant and stress-free.

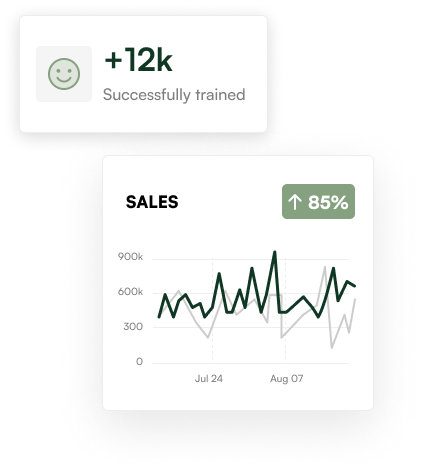

Simple Steps to Success

Speak With A Payroll Specialist

Don’t let payroll slow you down. Let us handle the numbers while you focus on growing your business.

Ready to start?

Payroll doesn’t have to be complicated. We make it easy, accurate, and hassle-free.