Personal Tax Filing

March 30, 2025 2025-03-30 1:25Personal Tax Filing

Personal Tax Filing

Personal Tax Filing

Tax season doesn’t have to be stressful. Whether you’re a W-2 employee, self-employed, or managing multiple income streams, SimpleBooksNow makes personal tax filing fast, accurate, and bilingual.

Stress-Free Tax Filing for Individuals & Families

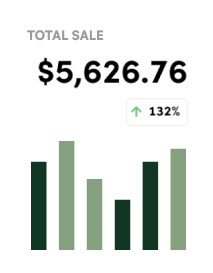

Maximize Your Tax Refund.

Maximize Your Refund. Minimize Your Headaches.

At SimpleBooksNow, we help individuals and families file their taxes correctly and on time. Whether you're dealing with W-2s, 1099s, investments, or dependents—we guide you through it all with ease.

What’s Included:

Federal & state personal tax return preparation

W-2 and 1099 income filing

Child tax credits and dependents

Deductions and credit maximization

Bilingual support (English & Spanish)

Filing for self-employed individuals & freelancers

Step 01

We Collect & Organize Your Info

You provide your income documents, deductions, and dependents—we do the organizing, prepping, and checking.

Step 02

We Prepare & Review Your Return

We calculate your return, look for savings opportunities, and review everything with you before filing.

Step 03

We File & Keep You Informed

We submit your return to the IRS and state agencies, and keep you updated on refund status or next steps.

Simple Steps to Success

Speak With a Personal TaxReturn Specialist

Don’t leave money on the table—or risk filing errors. We’ll make sure your taxes are handled right, with care and attention.

Ready to start?

Our process is simple, fast, and tailored to you. Get expert help today.