Tax Compliance

March 30, 2025 2025-03-30 2:40Tax Compliance

Tax Compliance Services

Tax Compliance

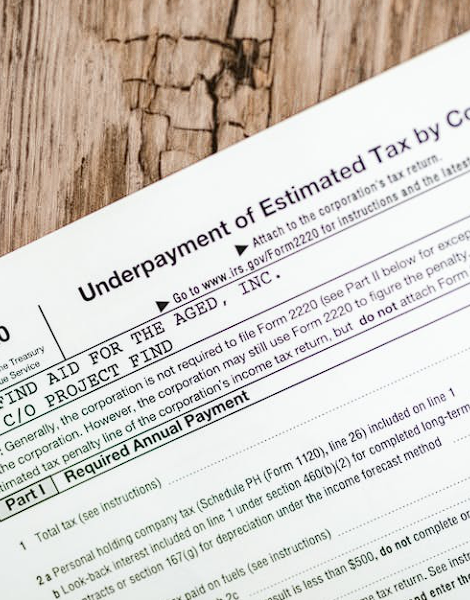

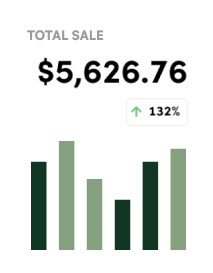

Worried about staying on the IRS’s good side? Our Tax Compliance services help you meet every deadline, file correctly, and avoid costly penalties—so you can focus on running your business with confidence.

Tax Compliance Services

Stay Compliant.

Stay Confident.

At SimpleBooksNow, we ensure your business is up to date on all tax filings and regulatory requirements. From quarterly payments to annual returns, our team makes sure nothing slips through the cracks.

Tax laws can be overwhelming—we make them manageable.

What’s Included:

Sales tax filings and reporting

Estimated tax payment planning

Federal and state compliance tracking

IRS correspondence handling

Late filing resolution

Ongoing compliance monitoring

Step 01

We Review Your Compliance Status

We begin with a full review of your current standing with the IRS and state agencies—checking for missed filings, overdue forms, or risky gaps.

Step 02

We Correct and Catch Up

We file late returns, resolve notices, and get you back on track with the right documentation and communication.

Step 03

We Keep You Current

With monthly and quarterly support, we monitor deadlines, prep reports, and ensure you never miss another filing again.

Simple Steps to Success

Speak With A Tax Compliance Expert

Never stress over a tax deadline again. We’ll help you stay organized, compliant, and focused on your business—not paperwork.

Ready to start?

One missed form can trigger penalties—let us make sure that never happens.