Tax Discovery

March 29, 2025 2025-03-29 20:00Tax Discovery

Business Tax Discovery & Audit

Business Tax Discovery

If you're unsure whether your taxes were done right in the past—or you suspect you're missing deductions—our Tax Discovery service is for you.

Tax Discovery Services

Uncover Hidden Opportunities in Your Tax History

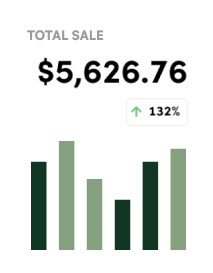

At SimpleBooksNow, we take a deep dive into your previous filings, current liabilities, and overall tax strategy to uncover missed savings, fix costly mistakes, and set you up for success moving forward.

Whether you're a business owner or an individual, this is your chance to get clarity, confidence, and possibly money back.

What’s Included:

In-depth review of past tax returns

Identification of errors or red flags

Discovery of missed deductions or credits

Filing corrections and amended returns

Guidance on how to stay audit-ready

Step 01

We Start With a Deep Dive

We carefully examine your previous filings to look for inconsistencies, missing deductions, or any audit triggers. We gather the details most people—and even many tax pros—overlook.

Step 02

We Spot What Others Missed

If we find anything worth fixing, we’ll recommend the necessary corrections, help you file amendments, and show you how to avoid those mistakes going forward.

Step 03

We Build a Better Path Forward

Beyond just fixing the past, we help you build a smarter tax strategy going forward. You’ll be better prepared, better protected, and better informed.

Simple Steps to Success

Speak With A Tax Discovery Professional

Take control of your tax history and ensure your returns are working in your favor. Don’t leave money on the table or risk an audit due to avoidable errors.

Ready to start?

Most people don’t even realize what they’re missing. Our Tax Discovery process gives you a second chance to do it right—and potentially recover what’s yours.