Tax Planning Services

March 30, 2025 2025-03-30 2:45Tax Planning Services

Tax Planning Services

Tax Planning Services

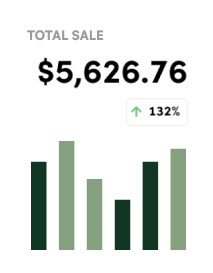

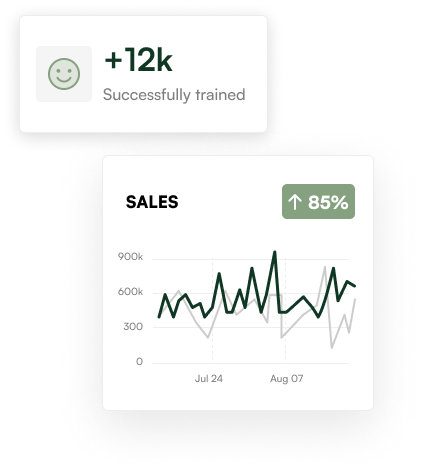

Smart business owners don’t wait until tax season—they plan ahead. Our Tax Planning Services help you reduce your liability, take advantage of deductions, and build a proactive financial strategy that supports your growth year-round.

Year-Round Tax Planning Solutions

Reduce Surprises Maximize Savings.

At SimpleBooksNow, we don’t just file taxes—we help you plan smarter, keep more of what you earn, and avoid costly mistakes before they happen. Our tailored tax planning services help you make strategic financial moves with confidence.

What’s Included:

Tax strategy consultations (quarterly or annual)

Entity selection and restructuring advice

Income & deduction planning

Retirement & investment tax strategies

Expense forecasting and planning

IRS compliance checkups

Step 01

Assess Your Current Tax Strategy

We evaluate your past filings, business structure, and current income to identify opportunities for improvement and savings.

Step 02

Build a Strategic Tax Plan

We map out tax-saving moves aligned with your business goals—timing income, maximizing deductions, and exploring credits and retirement tools.

Step 03

We Guide You Year-Round

We provide proactive reminders, quarterly reviews, and ongoing support so you’re always prepared—no scrambling at year-end.

Simple Steps to Success

Speak With A Tax-Planning Advisor

Get ahead of the IRS with a proactive tax plan designed just for you. Our experts help you reduce liability, boost profitability, and stay compliant.

Ready to start?

Don’t wait for tax season. Let’s build your plan now and save more all year long.